Surcharging and Cost of Acceptance

The Reserve Bank of Australia (RBA) has established changes to card payments regulations banning excessive payment surcharges and providing new powers for the Australian Competition and Consumer Commission (ACCC).

This new standard affects the amount that merchants can surcharge for card transactions. The standard applies to all business/merchants that impose payment surcharges on payment transactions regardless of their size.

If a business chooses to impose a surcharge on its customers for making a payment using a credit, debit or prepaid card, the level of the surcharge must not be excessive.

A payment surcharge is considered excessive if it exceeds the cost of acceptance.

You do not have to impose payment surcharges on accepted payment methods. If you do not impose any payment surcharges on your customers, the ban will have no impact on you.

The full ACCC Guidelines can be viewed online.

What payments are affected?

The regulations cover surcharges on typical card payment methods:

- Eftpos (debit and prepaid);

- MasterCard (credit, debit and prepaid);

- Visa (credit, debit and prepaid); and

- American Express companion cards (issued through an Australian financial service provider, rather than directly through American Express).

What costs can be included when working out a surcharge

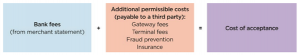

If you choose to impose a payment surcharge on a payment method covered by the ban, the amount of the surcharge must not exceed your cost of acceptance for that payment method.

Your costs of acceptance are provided to you on a statement from your bank (acquirer) or payment service provider, typically shown as a percentage figure amount.

For most businesses, the fees include:

- merchant service fees;

- fees paid for the rental and maintenance of payment card terminals; and

- any other fees incurred in processing card transactions, including cross-border transaction fees, switching fees, and fraud related chargeback fees (but not the cost of any actual chargebacks).

You can also choose to pass on additional permissible costs, but you are required to calculate the permitted surcharge yourself.

Additional permissible costs paid to other providers are:

- gateway fees paid to a payment service provider;

- the cost of fraud prevention services paid to an external provider;

- any fees paid for the rental or maintenance of card terminals paid to a provider other than your bank or payment facilitator; and

- the cost of insuring against forward delivery risk.

These must be able to be verified by contracts, statements or invoices.

Businesses cannot include any of their own internal costs when calculating their surcharges (for example, labour or electricity costs).

Calculating your Cost of Acceptance

Source: ACCC

Can I impose a flat fee surcharge?

If your costs of acceptance are charged to you in percentage terms, it will typically be appropriate that any surcharges you impose will also be expressed as percentages.

The ban does not prevent you from imposing a payment surcharge as a flat or fixed fee, however, you will need to ensure that the amount of the surcharge does not exceed your cost of acceptance for any given transaction.

If you wish to impose a single surcharge across multiple payment methods, you must set the surcharge at the level of the lowest cost method – you can’t average across the methods.

Example

If your average cost of acceptance for Visa Debit is 1%, for Visa Credit is 1.5%, and for American Express is 2%, you would only be permitted to charge the same level of surcharge for each payment method if it was 1%, as that is the lowest of all payment methods. You would not be allowed to use an average of the three figures.

What if I don’t comply with the ban?

The ACCC is responsible for enforcing the ban and can take the following actions:

- issue an infringement notice with penalties of up to $3,320 (body corporate) or $133,200 (listed corporation); and

- take court action seeking pecuniary penalties of up to $1,436,562 for a body corporate.

More information on surcharging and cost of acceptance

More information is available from your bank, payment service provider or the Reserve Bank of Australia resource page – Questions and Answers on Card Payments Regulation.

Author: Mangala Martinus, Managing Director, Australia, Payments Consulting Network and Merchant Advisory

***

If you found this article helpful and would be interested in reading similar articles by our consulting team, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass in the top righthand side of the website, and type in the key words that interest you. You will then be presented with a list of any articles that match your search criteria.

***

As part of Merchant Advisory’s Payments Optimisation Review service we look at the potential impact of implementing surcharging on sales and cost reduction. If you would like advice on this topic, then please contact us.