How Online Payment Pricing Models Are Made: The Ultimate Guide to Transaction Fees within Interchange Plus Plus and Blended Pricing model

If you’re doing business online, card transactions probably take up a large proportion of your payments. So, you might ask yourself some questions: What am I paying for? How are card processing fees set? Our guide is designed to help you find answers to the most common questions about payment card processing fees and different pricing models.

If you’re doing business online, card transactions probably take up a large proportion of your payments. So, you might ask yourself some questions: What am I paying for? How are card processing fees set? Our guide is designed to help you find answers to the most common questions about payment card processing fees and different pricing models.

The most widely used pricing models are Interchange Plus Plus Pricing and Blended Pricing.

We’ll explore these pricing models in more detail shortly, but first, let’s take a look at the fees that form these models. This article, written by Deniss Gusakovs, Product Owner from Ecommpay, provides valuable insights into these topics.

The article covers:

- Pricing models: the advantages of Interchange Plus Plus and Blended Pricing

It’s important to know how Payment card processing consists of three fees:

- Merchant service charges or processing fees – the fees you pay to a payment service provider / acquirer for transaction processing.

- Card scheme fees – the fees an acquirer is obliged to pay to Visa / Mastercard or other card schemes for their services and network.

- Interchange fees – the transfer fees between issuers and acquirers used to maximize the growth of the payment network for the benefit of all participants.

A closer look at the three fees making up card processing costs

Merchant service charges or processing fees

This fee is the payment service provider’s/acquirer’s margin. In order to process card payments, you as a merchant must have a signed contract and an open merchant’s account with a service provider / acquirer who is authorised to provide such services. The fee may vary depending on different factors, such as transaction type, risk level, transaction volume, etc. Note: fee tiers can be applied, usually based on the number of transactions per period or transaction volume per period.

It is important to understand that everything comes at a reasonable price, as payment service providers/acquirers have to maintain their IT infrastructure, as well as to comply with payment systems and legal requirements, thus their service is not free.

Card scheme fees

The scheme fees are those an acquirer is obliged to pay, depending on the payment system used, to Visa / Mastercard.

These fees can be divided into the following blocks:

- 3-D Secure fee: an acquirer must pay for each authentication request, even if an attempt was not successful.

- Authorisation process fees are the fees related to the process of approving or declining a transaction by the issuer; the request is passed on by the IPS (International payment systems). These fees are due for payment no matter whether the transaction was successful or not.

- Clearing fees are the fees related to the process of delivering final transaction data from acquirers to issuers using the Card Scheme network for posting to the cardholder’s account. Clearing also includes the calculation of certain fees and charges that apply to the issuer and acquirer involved in the transaction, as well as the currency exchange into the appropriate settlement currency.

Many variables determine the exact fees applied at this stage. Here is a short summary of the dependencies:

- The transaction types, e.g. purchase, payout, refund, etc.

- Transaction regions according to Visa/Mastercard or other Card Schemes definition and requirements.

- Country-specific fees related to market development.

- Transaction tier – could be as an aggregated quantity for a period of time, as well as a particular transaction amount.

- Card product platforms (debit/ credit/ prepaid etc.).

- Card-not-present/Card-present indicators – transactions that take place without the physical presence of a cardholder and a payment card, e.g. online payments, or with the presence of a cardholder and a payment card e.g. physical POS transactions.

- Merchant outlet location.

- Transaction currency – this variable can be broken down even further and the fees can change; here are some examples of the dependencies regarding the currency:

- the transaction currency does not correspond with the merchant’s outlet location local currency;

- the transaction currency does not correspond with the official currency of one of the EEA members + Switzerland;

- the transaction currency does not correspond with the settlement currency (settlement to the acquirer);

- FX rates used by the payment systems for calculation;

- as well as the currency region (European vs Non-European) can affect the fees.

Interchange fees

The interchange fee is a member-to-member transfer fee assessed on the entire transaction amount submitted by the acquirer for clearing & settlement. Generally, the acquirer reimburses the issuer for purchase transactions whereas the issuer reimburses the acquirer for cash and ATM transactions.

“Visa/Mastercard and other card schemes provide a platform and a set of rules for both parties, an acquirer and an issuer; card schemes are responsible for technical infrastructure within clearing and money movement (settlement) processes.”

There are many transactional factors that affect the interchange fee, such as:

- The transaction types, e.g. purchase, payout, refund, etc.

- Transaction regions according to Visa/Mastercard or other Card Scheme’s definitions and requirements.

- Card product platforms (debit/ credit/ prepaid etc.) have different interchange rates.

- Card product types (consumer or commercial products; appropriate product types in accordance with each Card Scheme’s products catalogue – Gold, Platinum, Infinite, Titanium, etc.).

- Type of your business/ industry – some industries and businesses are associated with more risks than others, which results in different interchange rates.

- Type of transaction – CNP (card-not-present) transactions are riskier than POS (point-of-sale) since with physical card presence extra security is in place, e.g. PIN, signature, etc.

So now you have a clearer picture of who you are paying, what fees there are, and why. The next step is to move on to the different pricing models that a business can operate under, and take a look at how transaction fees are reflected in those models.

Pricing models: IC++ and Blended Pricing

Transaction fees are based upon a number of factors, such as the type of transaction, the card type being used, your geographic location, and other factors. In order to empower yourself and understand exactly what you are paying for, you have to understand the structure of pricing models.

Here are two ways how transactional charges are traditionally applied:

- Blended pricing, where all costs of the transaction and an acquirer’s desired income are blended into one essence; under this model, the risks of excessive costs are covered by the acquirer, a merchant doesn’t have to worry about any variables.

- Interchange++ is a pricing model where the fees for transactions are broken down into separate components comprising the interchange, the scheme fee, and the acquirer’s fee.

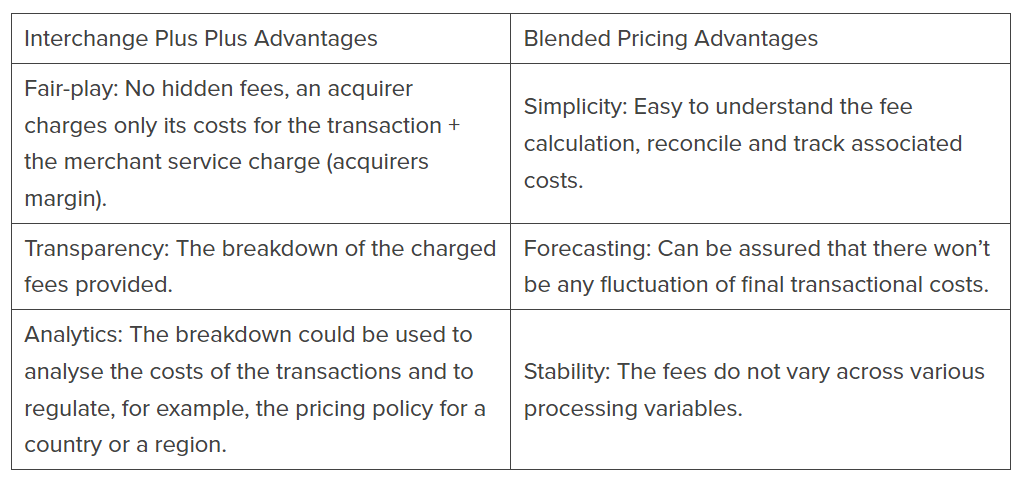

Both pricing models have their advantages; it is all about finding the most suitable one for your business.

Summing up the advantages

Now you know what each fee involved in card processing means, why it is in place and what the two most commonly used pricing models are. Here are some of the key advantages of each model for you to take into consideration when choosing the most suitable one to help your business grow.

To optimise payment efficiency and security, businesses should collaborate with a reputable payment service provider like Ecommpay for tailored solutions that align with their specific online transaction needs.

***

This article was first published by Ecommpay and has been republished on our website with permission.

Ecommpay is a member of our Payment Service Provider panel.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.