Five Payments Trends to Watch in 2023

The payment industry was already undergoing changes when the pandemic hit, causing significant changes in consumer buying patterns and expectations. Now, with the first phase of ISO 20022, the industry may well be entering an entirely new era. Although we cannot predict the future, a report by LexisNexis Risk Solutions can provide an informative summary of the top five payment trends to watch in 2023.

The payment industry was already undergoing changes when the pandemic hit, causing significant changes in consumer buying patterns and expectations. Now, with the first phase of ISO 20022, the industry may well be entering an entirely new era. Although we cannot predict the future, a report by LexisNexis Risk Solutions can provide an informative summary of the top five payment trends to watch in 2023.

-

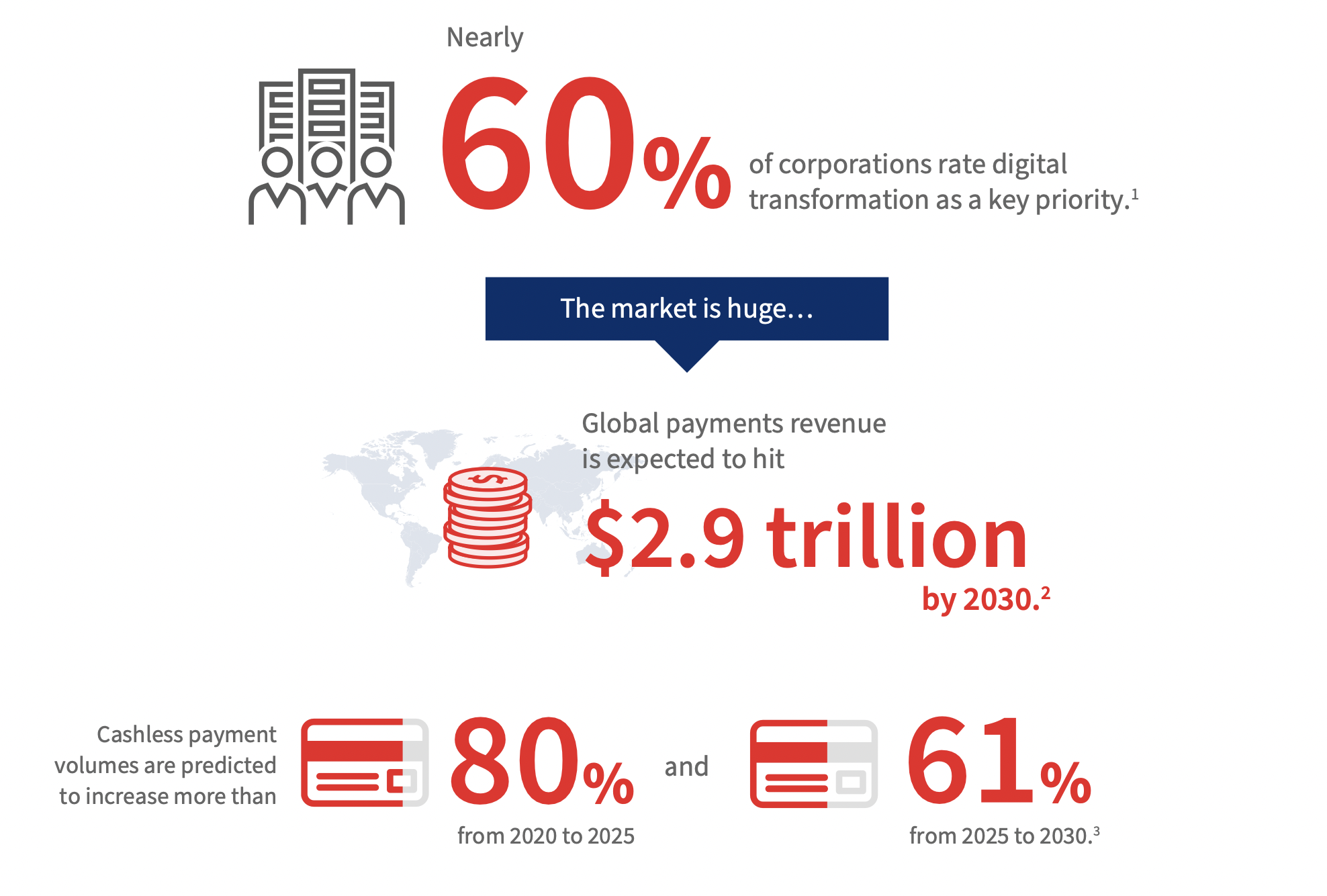

Digital transformation continues full speed ahead

The pandemic fast-tracked digital transformation as financial institutions and corporates rushed to catch up to new providers that offered a more modern payments infrastructure better aligned to a real-time world and customer expectations. Digital transformation is no longer just about automating manual processes but also about creating new business models and revenue streams. It’s no longer “a nice to have” but rather a strategic priority industrywide. To gain efficiency and compete more effectively, further in 2023, we can expect organisations to continue this trend and update their technology stacks to stay competitive. This will require a shift in mindset and a willingness to experiment, take risks and embrace cloud computing, artificial intelligence, machine learning, and other emerging technologies.

Prediction report on the impact of digital transformation among corporations and users

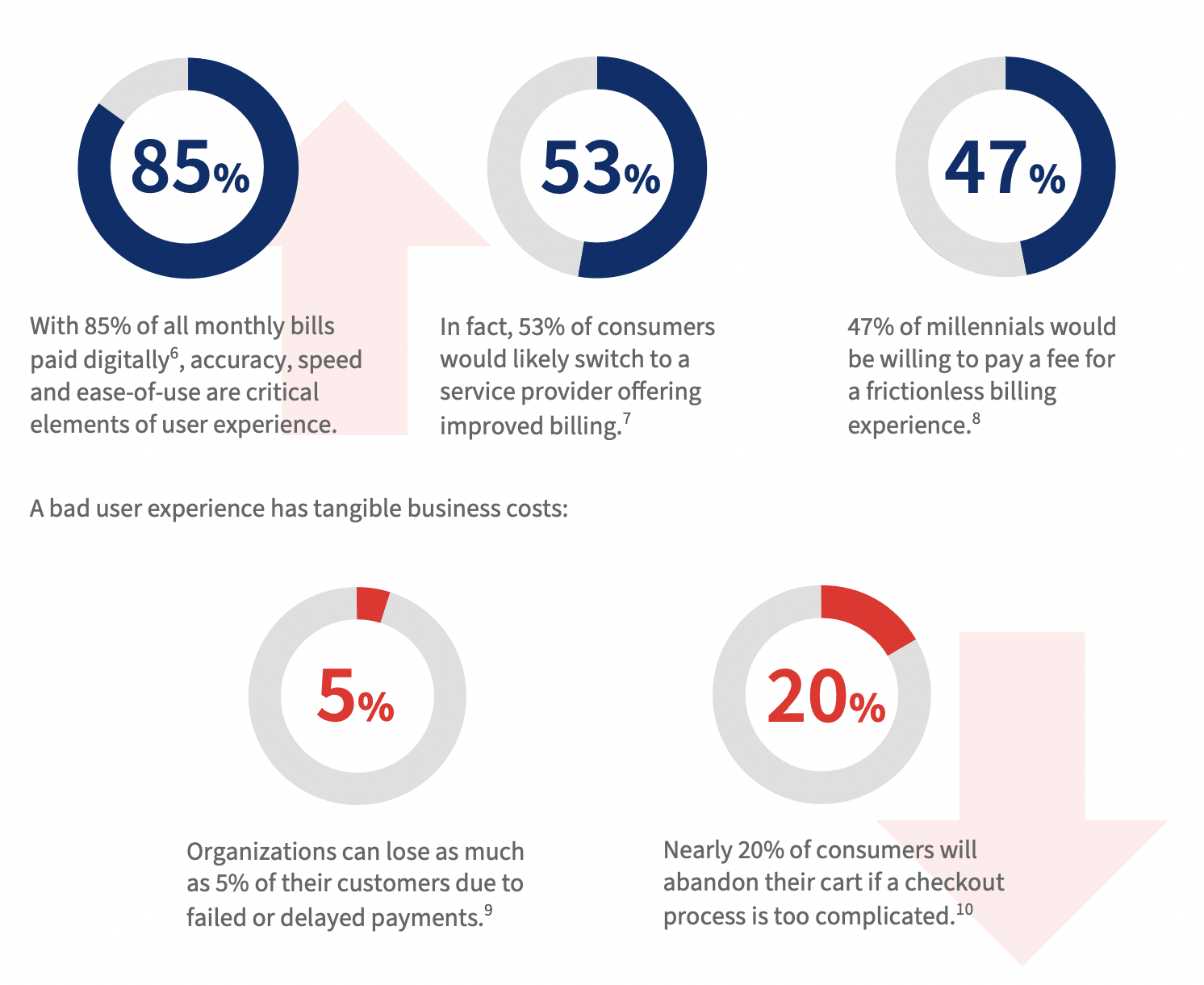

2. The customer reigns supreme

All eyes are on the customer. As customers’ expectations for speed and convenience continue to rise, businesses that offer fast, frictionless payment options can provide a better customer experience and increase loyalty. By simplifying the payments process and reducing friction, businesses can also reduce the likelihood of abandoned transactions and drive growth. In addition, offering fast and streamlined payments can improve cash flow and provide greater visibility into financials, helping businesses make more informed decisions. This focus on improving payment processes can also lead to increased efficiency and cost savings, as manual and time-consuming tasks are replaced with automated solutions. Overall, businesses that prioritise fast and frictionless payments in 2023 are likely to see improved customer satisfaction, increased revenue, and long-term success.

Survey revealing high demand for frictionless transactions and impact on UX

3. Payments data enhances benefits of FRAML

The convergence of fraud and anti-money laundering (FRAML) is poised to bring greater focus on payments data in 2023. Sharing payments intelligence across business functions provides a more complete picture of the customer for better risk assessment, faster onboarding and more assured compliance. Linking payments functionality with an organisation’s FRAML framework and the enriched message formats of ISO 20022 will deliver even greater efficiencies.

Estimate of the total costs involved in complying with regulations and combating financial crime

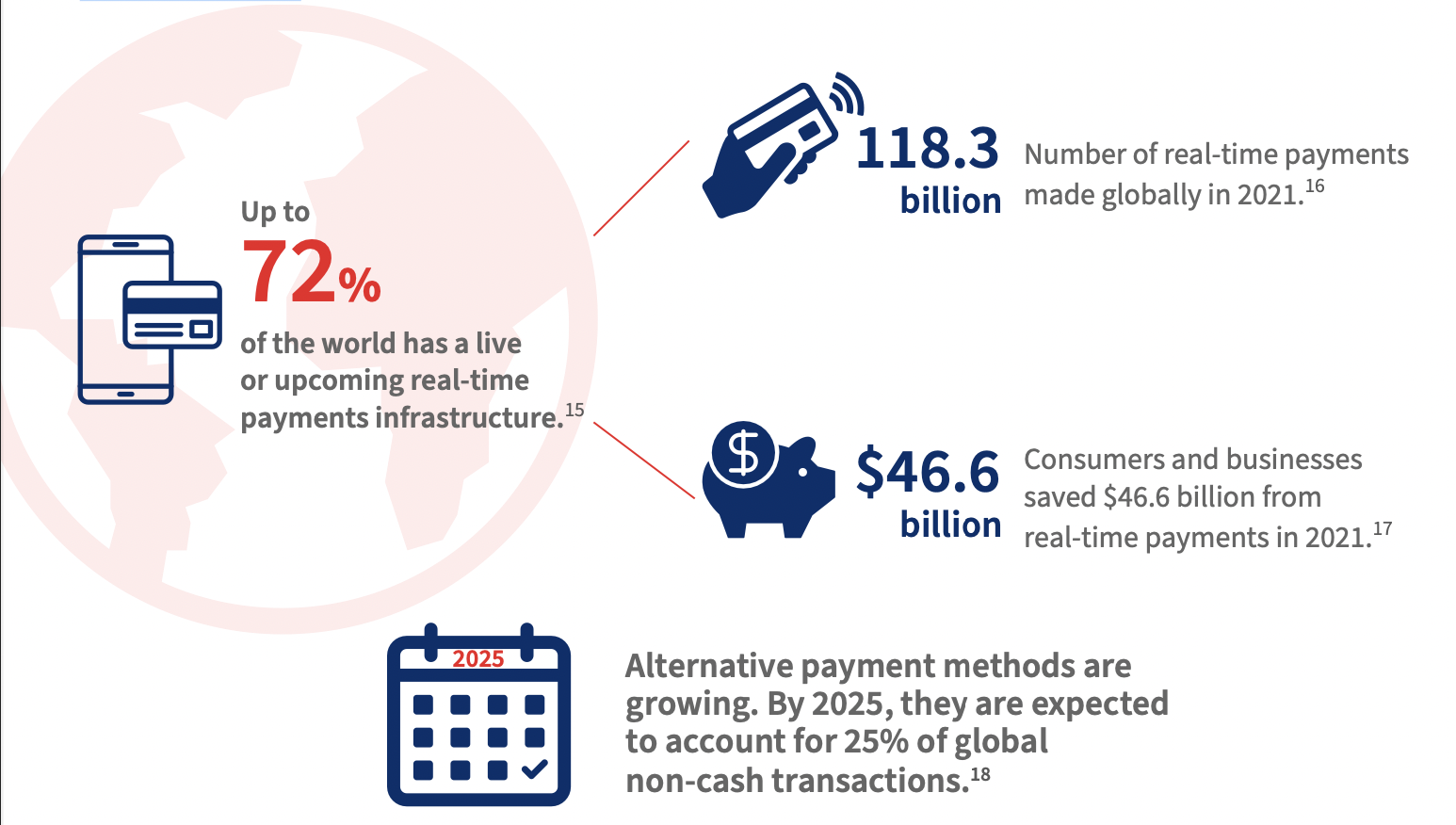

4. Adoption of end-to-end payments platforms makes significant headway

As software and services are increasingly incorporated into payments platforms to provide a more turnkey model, the fragmentation and diversity of payments platforms will continue to grow. To address this issue, organisations must integrate their payments platforms, software, and services to create a seamless end-to-end solution. By doing so, they can enjoy faster transaction processing, improved productivity, reduced fees, and an enhanced overall customer experience. Failing to integrate payments platforms can lead to inefficiencies and higher costs, putting companies at a competitive disadvantage. The organisations that prioritise integration and provide a comprehensive payments solution will be better positioned to succeed in the evolving payments industry.

Impact of real-time payments infrastructure in the current landscape

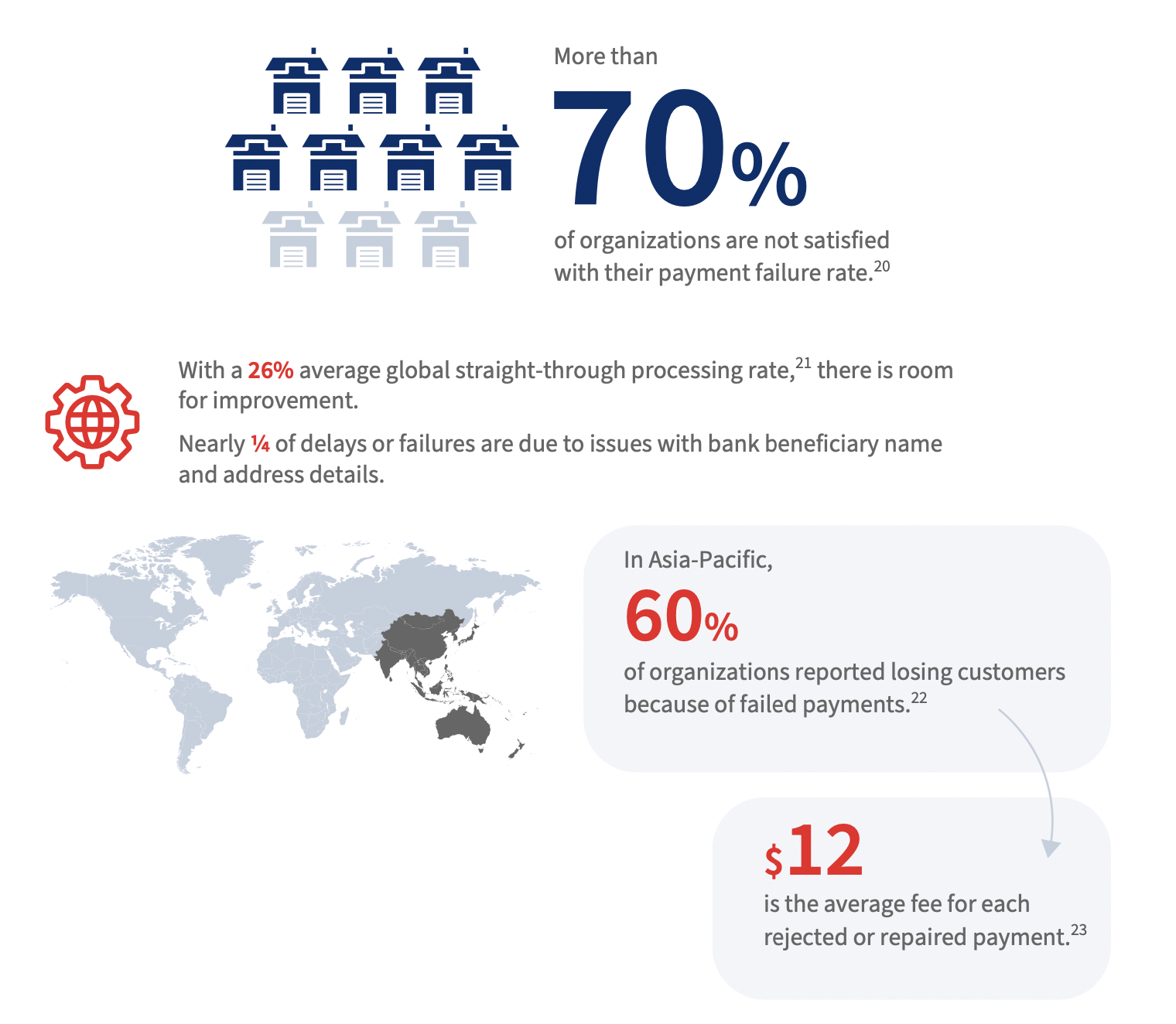

5. Failed payments remain top of mind

In 2020, failed payments resulted in an estimated global loss of $118.5 billion, highlighting the need for improvement in the payments industry. Reducing failed payments is a priority for businesses in 2023 as they represent a significant cost, not just in terms of lost revenue but also in lost customers. Organisations must focus on improving payment processes to avoid losing valuable revenue and customers.

With some organisations sending over 1,000 payments per minute, even a small number of failed payments adds up quickly in bank fees and time spent identifying and fixing errors.

To meet the changing needs of the payments landscape, businesses need solutions that are fast, accurate and secure, while also focusing on providing a seamless customer experience throughout the payment process. Organisations to prioritise adopting solutions that can keep up with the pace of change and meet customer expectations. By doing so, businesses can maintain a competitive edge and build long-lasting customer relationships.

Get the full report on 5 Payments Trends in 2023 here

This article/report was first published by LexisNexis Risk Solutions and has been republished on our website with permission.

***

If you found this article helpful and would be interested in reading similar articles, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass in the top right hand side of the website, and type in the keywords that interest you. You will then be presented with a list of any articles that match your search criteria.

***

Sources:

1.https://risk.lexisnexis.com/about-us/press-room/press-release/20220519-capgemini-invent-and-lnrs-explore-evolution-corporate-payments

2.https://web-assets.bcg.com/58/30/e7773b6a4c29b79b3673ab21ef66/bcg-global-payments-2021-report-all-in-for-growth-oct-2021-r.pdf

3.https://www.pwc.com/gx/en/financial-services/fs-2025/pwc-future-of-payments.pdf

4.ibid

5.https://web-assets.bcg.com/58/30/e7773b6a4c29b79b3673ab21ef66/bcg-global-payments-2021-report-all-in-for-growth-oct-2021-r.pdf 6.https://www.pymnts.com/consumer-payments/2022/half-of-consumers-would-switch-providers-for-better-bill-payment-experience/

7.ibid

8.ibid

9.LexisNexis® Risk Solutions True Impact of Failed Payments

10.https://baymard.com/blog/checkout-flow-average-form-fields#checkout-form-fields

11.LexisNexis® Risk Solutions True Cost of FraudTM Global Report, July 2022

12.https://risk.lexisnexis.com/insights-resources/research/us-ca-true-cost-of-fraud-study

13.https://risk.lexisnexis.com/global/en/insights-resources/research/true-cost-of-financial-crime-compliance-study-global-report

14. Chartis research

15. https://www.thunes.com/how-real-time-payments-are-going-global/

16. https://www.aciworldwide.com/wp-content/uploads/2022/04/Prime-Time-for-Real-Time-Report-2022.pdf

17. ibid

18. https://www.fibonatix.com/resources/rise-of-alternative-payment-methods/

19.https://www.prnewswire.com/news-releases/accuity-study-reveals-failed-payments-cost-the-global-economy-118-5-billion-in-2020–301333385.html

20. ibid

21. ibid

22.https://solutions2.risk.lexisnexis.com/true-cost-of-failed-payments-infographic-apac?cmpid=DSC|BAPA|BASUG-20211122-APAC-EN-TCOFP21_APACInfoG_FNN_Article&sfid=7014G000000j2XyQAI

23.ibid