Friendly Fraud and Pending Mitigation

A Rose by any other name

Friendly fraud is an oxymoron. Like deafening silence, it pierces the frontal lobe. There is neither solace nor refuge. It’s sponsored thievery. Merchants have reluctantly harboured its weight for the benefit of accepting card payments. Mercifully, there may be some measured relief in the coming months.

Friendly fraud is a type of cardholder fraud. Visa estimates friendly fraud makes up 75% of all chargebacks. A customer purchases an item online and then disputes the item, even though it was either a legitimate transaction or authorised by someone else in their household. It is perpetrated for numerous reasons. The reason may be an honest mistake such as the cardholder does not recognise or recall the charge. They may have granted authorisation to another person and forgotten they had done so. It may, however, be for a more deliberate actions such as:

- It’s easier to receive money from a card issuer or

- The cardholder simply intended to defraud the merchant

Injury to Insult…..

Some merchants have gone to great lengths to recover their money even though they lost the chargeback dispute. For example, merchants have found websites, stood up by individuals who acquired their product through friendly fraud. The merchant loses the chargebacks and then has to engage with counsel to shut down the website.

Mastercard Alert to Control High Risk Merchants (MATCH)

Further frustrating merchants is that Visa has a Rule where if merchants exceed a 0.90% chargeback ratio, they will face a stiff and escalating fee schedule. They may also be closed by their acquirer and added to MATCH which is excruciating and renders it difficult to obtain merchant processing.

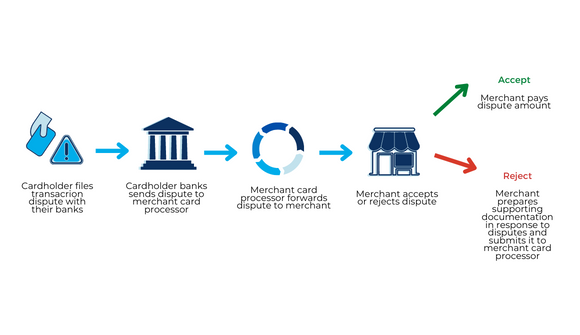

From Visa’s website we can see the path an initial dispute follows:

With regards to honest mistakes, there are some actions a merchant may take to lessen those dispute types. Proactive notifications, obvious descriptors and liberal return policies, are amongst the many actions a merchant may take to lessen honest mistakes. Merchants can and should analyse data for commonalities and adjust practices when warranted. Further, with pending Rule changes to Visa’s Dispute Resolution Rules, friendly fraud chargebacks may be mitigated.

Compelling Evidence

Until now, it was very difficult for merchants to win disputes in a card-not-present environment.

This is impactful as COVID accelerated the shift to eCommerce sales. Between 2019 and 2021, annual Visa card-not-present transactions grew 51%. To assist merchants, beginning April 15, 2023, merchants will be able to counter friendly fraud for specific consumer dispute chargebacks. According to Verifi’s website

“Compelling Evidence 3.0 (CE3.0) evolves the Visa dispute program by adding a set of checks and balances to draw a clear and direct relationship between the merchant and the cardholder with the use of greater data exchange to more accurately identify transactions authorised by the cardholder…”

Specifically for Dispute Condition 10.4: Other Fraud—Card-Absent Environment, may be remedied if the goods or services were provided and the same payment credential was used in two previous transactions that the issuer had not reported as fraud. At least two of the core data elements match between prior (undisputed) transactions and the disputed transaction and one of the two must be either IP address or Device ID as follows:

Prepare for the Best

This is wonderful and welcomed news for merchants. Merchants should consider these pending changes, evaluate the types of chargebacks it is receiving in order to prepare for the coming changes. For example, if a merchant is aware it is receiving a significant volume of this type of consumer dispute chargeback, it should validate that it has the necessary data and process to refute these come April of 2023. By doing so, it will be better prepared to dispute and win against friendly and unfriendly fraud.

Author: Ken Musante, Commercial Director, San Francisco, Payments Consulting Network

With over three decades of industry experience and a strong network within the U.S. Payments sector, Ken brings invaluable insights. He possesses extensive knowledge of the Payments industry’s infrastructure, pricing, and key players, including technology providers, financial institutions, card brands, processors, and vendors. Ken has expertise in integrating solutions through PayFac offerings and optimizing processes.

***

If you found this article helpful and would be interested in reading similar articles by our consulting team, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass in the top righthand side of the website, and type in the key words that interest you. You will then be presented with a list of any articles that match your search criteria.