How Apple Pay Changed Payments

Did Apple make payments cool?

Did Apple make payments cool?

Nowadays, businesses and fintech companies are offering a secure and convenient alternative to traditional payment methods, aligning with the consumer shift towards fast, frictionless transactions. This not only simplifies the checkout process but also sets a standard for future innovations in how we manage and interact with our finances in an increasingly connected world.

This article was originally written by our Commercial Director, Matt Jones, on his personal blog. Continue reading for additional insights on Apple Pay and its innovative methods that enhance transaction processes in today’s digital landscape.

One of the biggest changes in payments in the past 20 years was the introduction of Apple Pay. I can remember the day it was announced, in September 2014. It may seem strange to remember such a thing, but for payments aficionados it was a big deal.

Why was it such a big deal? Because Apple Pay accelerated contactless payments.

A personal anecdote highlights this. A few years ago, my Mom was visiting me in London.

While in a cafe, I barely noticed it happen, but my Mom effortlessly paid our bill using Apple Pay on her Apple Watch. I hadn’t shown her how to do this, so I thought it was cool to see how someone from the Baby Boomer generation (born between 1946 and 1964) had embraced payments via a watch.

This highlighted to me the extent to which payments had become embedded into devices.

And to a large part, Apple Pay was the key factor in making this happen.

A sticker on the window of a shop recently seen in London. This small business highlights not only that it accepts card payments but also that other physical form factors can be used. These other form factors are ultimately linked to an underlying card for payment. Yet, for the average consumer, knowing that their respective physical devices can be used is a smart strategy. In many ways, we are beyond cards. This merchant was using the payment provider Dojo.

Going back to 2014, Apple was behind the times. Every other major phone maker had NFC (Near Field Communications) in their devices. Speculation built as to when Apple would follow suit. The iPhone 6 launch gave the public – or at least the tech community – what they wanted, with even more on top. The company finally included the short-range wireless technology into its latest smartphone, the iPhone 6, and the bigger iPhone 6 Plus. It also announced Apple Pay, a digital wallet which can be accessed securely using the fingerprint Touch ID technology it had for its models.

While there was excitement for the launch – for Apple Pay to function, retailers needed to have their payment infrastructure set up to accept NFC. Today, this is relatively standard, and most card payment devices feature NFC acceptance, but back in 2014, this wasn’t the case. At that time, much of the payment infrastructure in the United States still relied on swiping a card at the point of sale.

Getting Contactless Going

With the lack of NFC acceptance devices, one of Apple’s main competitors saw an opening. In early 2015 Samsung acquired and integrated LoopPay. LoopPay was a startup that enabled payments via a Samsung phone – even if the Point of Sale was still Swipe-only. The LoopPay functionality was embedded in the Samsung Pay wallet and became known as Magnetic Secure Transmission (MST).

MST was a USP for Samsung, at least for a while. When NFC became more widely available, MST lost its relevance. For most Android users, Google Pay eventually became the go-to application for mobile payments on the platform. (Google Pay was available across the whole Android ecosystem, whereas Samsung Pay was restricted just to Samsung devices.) Samsung cannot be blamed for trying though, and it’s hard to underestimate just how nascent the market for contactless payments was back in 2014.

“Contactless payments, also known as Tap to Pay, arrived in the U.S. in 2014 with the launch of mobile wallets, however adoption remained nascent until 2018 when Visa financial institutions began issuing contactless cards in earnest.” – Daniel Sanford, Head of Product for North America, Visa

On the other hand, contactless payments were already well-established in the UK by 2014. In the lead-up to the 2012 Olympics, there was a significant push for card acquirers and large merchants to adopt contactless payment systems. All London Olympics venues encouraged contactless payments, and over 2,000 devices were deployed, but as Visa was one of the main sponsors, only Visa cards could be used.

Other than the Olympics, the London transport network enabled contactless payments in 2012, initially on buses, with the Tube (Metro) following in 2014. From 2012, large retail chains were courted to add contactless payments. Initially, retailers needed separate devices just for NFC acceptance. Over time, the technology converged to a single device and got smaller. Today, contactless payments can be accepted on devices not much bigger than a payment card itself.

SumUp’s tiny Air card reader

One thing became clear. In every market where it launched, Apple Pay led to an acceleration in contactless payments. In the US – an iPhone centric market – the launch of Apple Pay led to more retailers deploying NFC technology in the years that followed. But the change was piecemeal, at least initially. In 2017, only 1% of Visa face-to-face transactions in the US were contactless. Yet by 2021, this had risen to 10%, and in 2023, this was now one in three. Apple Pay was a large driver of this. Most issuers only offered contactless following the demand created by the inclusion of NFC in iPhones. Having launched in 2014 users saw that it was fun to pay with Apple Pay, and retailers didn’t want to risk losing a sale if the cardholder couldn’t pay how they wanted to. Nothing changed overnight, but gradually, the market shifted.

One area where Apple Pay has undoubtedly accelerated innovation is with the Wallet app. Here Apple Pay has been a boon for fintechs. If you create a new account with a financial institution, then with Apple Pay, there’s no need to wait days for a credit or debit card to arrive at your home address. A card can be immediately loaded onto the wallet on an iPhone and then used with no delay – a great help when cards expire, are lost or stolen, or for a fintech to get a customer spending quickly.

On the Chinese social media app Xiaohongshu, also known as Little Red Book or RED, users frequently post screenshots of their Apple Wallets showcasing various payment and loyalty cards. Some users display the sheer number of cards they own, while others highlight their prestigious Gold, Platinum, and Private Bank cards.

For some users dropping the physical card entirely is a choice they are choosing to make. In a recent New York Times article, it was noted that many from Gen Z leave their wallets at home entirely these days. This can be especially true as some US states allow users to store a driving license within the Apple Wallet app. A 19-year-old interviewed in the article, emphasising how she leaves her wallet at home, states “if a store doesn’t accept Tap to Pay, I won’t give them business”. Apple Pay has played a large part in making this possible.

Don’t Forget Biometrics

At the start of this post, I asked the question: Why was having Apple Pay such a big deal? And I answered because Apple Pay accelerated contactless payments.

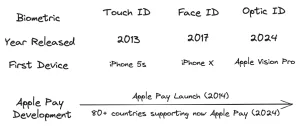

But there’s another side to this. Typically, contactless payments have a spending limit, which in the UK is £100, requiring additional authorisation for amounts above this. Apple Pay simplified this process with on-device biometrics. Simply put, biometrics uses a physical feature, like a thumbprint or facial scan, to authorise payments. This means that in physical retail settings, there’s no need to enter a PIN or provide a signature. Instead, Touch ID on older iPhones and Face ID on newer models handle transaction authorisation.

As a company that considers itself at the forefront of data security and privacy, without biometrics, Apple may never have launched Apple Pay. With Apple Pay, card numbers are never stored on the device, nor on Apple’s servers. Biometrics are safer and more secure than any other option for the benefit of both the consumer making the payment and the business selling their products.

Now with growing interest in Virtual Reality (VR), Augmented Reality (AR), and what Apple calls Spatial Computing, biometrics can evolve yet further. The Apple Vision Pro contains a technology called Optic ID.

Just as Touch ID revolutionised fingerprint authentication and Face ID did the same with facial recognition, Optic ID transforms authentication through iris recognition. Enabled by the Apple Vision Pro’s advanced eye-tracking system, which includes LEDs and infrared cameras, Optic ID offers secure and intuitive authentication using the unique patterns of your iris. With just a glance, it can unlock your Apple Vision Pro, authorise purchases and payments via Apple Pay, and even sign into supported apps. Any app that supports Touch ID or Face ID also automatically supports Optic ID.

The reception to Optic ID has been muted so far, reflecting the fact that few Apple Vision Pro headsets have been sold, and that it’s still only available in the US. Yet Apple’s description makes it clear that Optic ID is going to be the most intuitive and secure way to authenticate payments with a headset. Emphasising the security angle, at WWDC23, when unveiling Optic ID, it was stated that even identical twins have a different Iris composition.

Optic ID exemplifies how Apple Pay facilitates secure payments across various devices. Now that we can pay with a phone, watch, headset – one wonders, what will be next?

Author: Matt Jones, Commercial Director, London, Payments Consulting Network

With over 15 years in the payments industry, Matt has worked with notable organisations like Barclays and Elavon, as well as startups in the fintech space. His expertise spans diverse commercial sectors, including direct engagements with major merchants and banks. Matt excels in procurement-level insights, adeptly handling pricing models, strategic planning, and competitive analysis. He regularly writes on payments related topics at Payments Culture.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.