Kovena Report: Accommodation Payments Insights 2023

The 2023 Kovena payments survey for the accommodation sector in Australia was carried out in March and April 2023 and followed by compiling qualitative data behind the numbers via interviews with a range of accommodation types. In its intent to provide the deepest insights possible into Australia’s accommodation payments, 173 respondents from across Australia were surveyed, including one-room holiday apartments, B&Bs and resorts with over 400 rooms.

Most accommodations surveyed are frustrated with both the real cost of online payments services and the inconvenience. Pain points include chargebacks, refund costs, losses on no-shows, and a variety of other hidden costs.

This study will provide you with valuable perspectives on the following:

- Understanding the current landscape of accommodation payments.

- Importance of efficient payment collection from guests.

- Challenges faced in adopting modern payment solutions.

- Navigating the process and benefits of obtaining a merchant account.

- Uncovering hidden expenses associated with payment processing.

- Strategies for minimising chargebacks and losses due to no-shows.

Australia’s accommodation payments: the current state of play

Technology has advanced, yet 51% of hotels still use the same payment facility they did 5+ years ago.

What’s even more concerning is that the study records a substantial pre-stay risk for one in 5 hotels as nearly half (47%) of the accommodations have no online merchant facility and rely on manual card processing via an EFTPOS terminal. This means that sensitive card details are collected via email, fax, phone or in-person at check-in. In fact, 18% do not accept cards before check-in.

Apart from the security risks associated with manual handling of credit card information, collecting guest card details before arrival enables hotels to charge the card in accordance with their booking terms and conditions. Deposits can be collected along with any final payments due if there are non-refund periods set. Cards can also be pre-authorised prior to check-in to collect payments in the event of a no-show.

The study shows that 71% of hotels are unhappy with their current payment facility. Of the 53% of accommodations with a merchant facility allowing online payments to be collected, 13% utilise non-bank payment providers. The non-bank payment providers used include Stripe, Square, Currency Select, Windcave, Till and Pin Payments.

Following the pandemic, a prevalent concern is that 20% of hotels find it challenging to secure a merchant facility.

Payment providers experienced large losses during COVID as they were left to compensate travellers who’d paid in advance for accommodation and wanted their money back when accommodations closed, several permanently.

Banks in particular tightened access to merchant facilities requiring:

● extensive vetting (financial history, years of operation, and so forth)

● prior banking history with the bank

● large deposits to cover forward dated risk

Lag in Adopting New Options

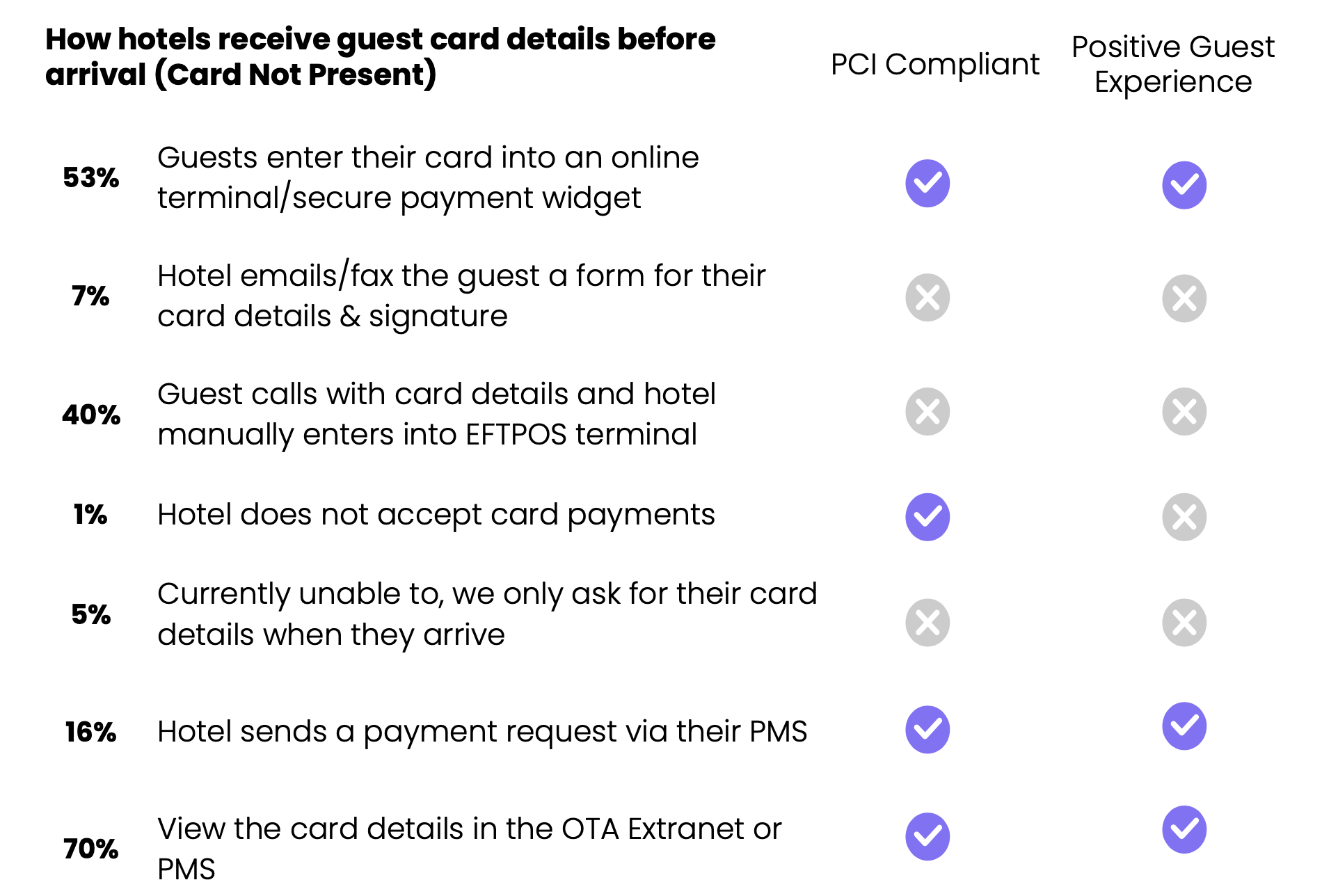

Hotels are obliged to handle their guest card details in a PCI Compliant manner to ensure data security and protection against breaches.

Hotel payment processes that involve emailing or faxing guests a form, as well as manually writing down card numbers when inputting them into physical terminals, pose significant risks of data hacks or breaches and fraud.

Collecting guest card details before arrival enables hotels to pre-authorise then charge the guest card for no-shows as per their booking terms and conditions. Reducing no-shows is crucial for hotels to maximise their revenue as empty rooms translate into missed and lost revenue. It is especially painful when occupancy is high and the room could otherwise have been booked by someone else. By implementing effective measures such as collecting and charging guests before arrival, hotels can optimise occupancy rates and capitalise on increasing revenue.

4% of guests do not show up for their booking. By thoroughly addressing and making the booking terms and conditions clear throughout the booking process to guests, hotels will not need to be left empty-handed when the guest does not show up for their stay.

True Cost of Payments

The true cost of payments are 300% higher than quoted costs. Kovena reported that accommodations found the true cost of the merchant facility, widely utilised by most of them, ranged from 4% and 6% of the total transaction value.

The major culprits mentioned were chargebacks, the inability to pre-authorise cards prior to check-in, resulting in lost revenue on no-shows, time spent processing refunds, time spent manually processing cards and other instances.

Insights During and Post COVID

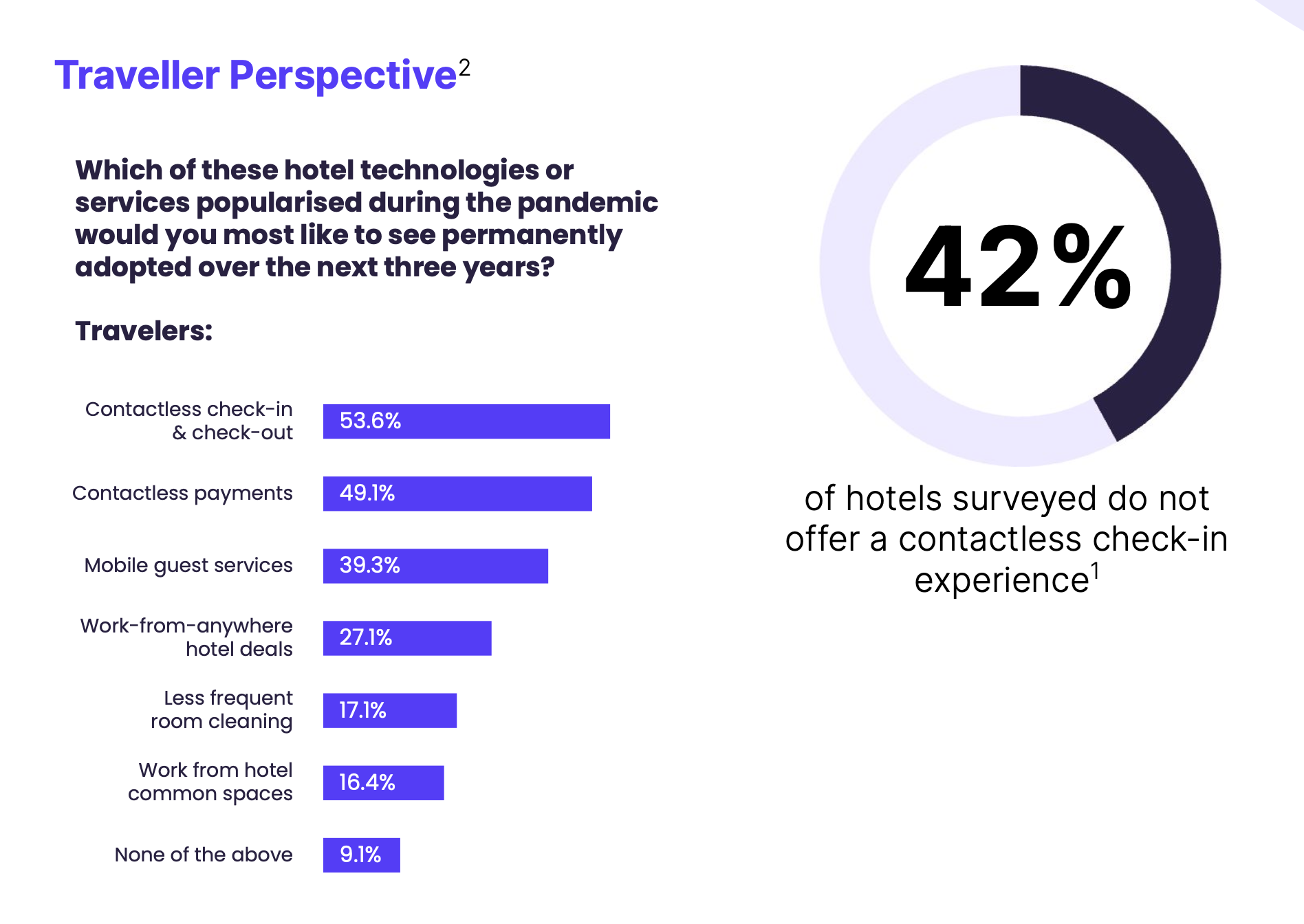

COVID has driven a large uptake in the use of contactless payments via EFTPOS and a surge in the use of e-wallets such as Apple Pay and Google Wallet over the past 3 years. One of the most positive developments which came out of the survey is the data showcasing that 71% of hotels now offer contactless payment options.

In addition with online payments, there has been a big push to use card details captured at the time of booking to make payment on site without the guests needing to physically submit their card at check-in or during their stay. The study records 58% of hotels also started offering contactless check-in with just a few clicks on their mobile devices.

Payment gateways such as Kovena serve as a pivotal element in digital commerce, going beyond facilitating online transactions to enhancing overall business efficiency. They elevate customer experience by ensuring a secure and seamless transaction process, while also expanding a business’s global reach.

For the complete insights on Accommodation Payment, download the report here.

This report was first published by Kovena and has been republished on our website with permission.

Kovena stands as an innovative payment solution tailored for the hospitality industry, dedicated to empowering tech ventures within this sector to harness their untapped revenue potential and propel their global expansion. Kovena not only offers an alternative to in-house expertise but also delivers adaptable, white-labeled technology that empowers platforms to concentrate on their core strengths and expertise.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.

***

Sources:

1. Kovena Australia Survey 2023

2. 2022 Skift / Oracle Report Hospitality in 2025: Automated, Intelligent … and More Personal