Open Banking – Revolutionising Payments and Meeting Consumer Demands

emerchantpay, a global payment service provider with over two decades experience in the global payments landscape, has released an Open Banking consumer report. The study sheds light on the rapidly evolving payments landscape and the transformative potential of Open Banking for meeting consumer demands.

Titled “Open Banking – Pushing the frontiers of payments”, the report is based on a survey of over 2,000 UK consumers, offering crucial insights into their current attitudes and preferences towards Open Banking.

Projections show that Open Banking is set to accelerate dramatically, with global transactions estimated to reach US $57 billion by 2023. Furthermore, Open Banking APIs are forecast to hit a staggering 580 billion worldwide by 2027, signalling a huge revenue opportunity for forward-thinking businesses.

Some key findings from emerchantpay’s research include:

- Around one in two (51%) respondents were unfamiliar with the term ‘Open Banking’. Upon finding out the definition of Open Banking, close to half of UK respondents claimed to have used it to make purchases.

- 42% of respondents are likely to use Open Banking for in-store payments, while 37% are inclined towards online payments.

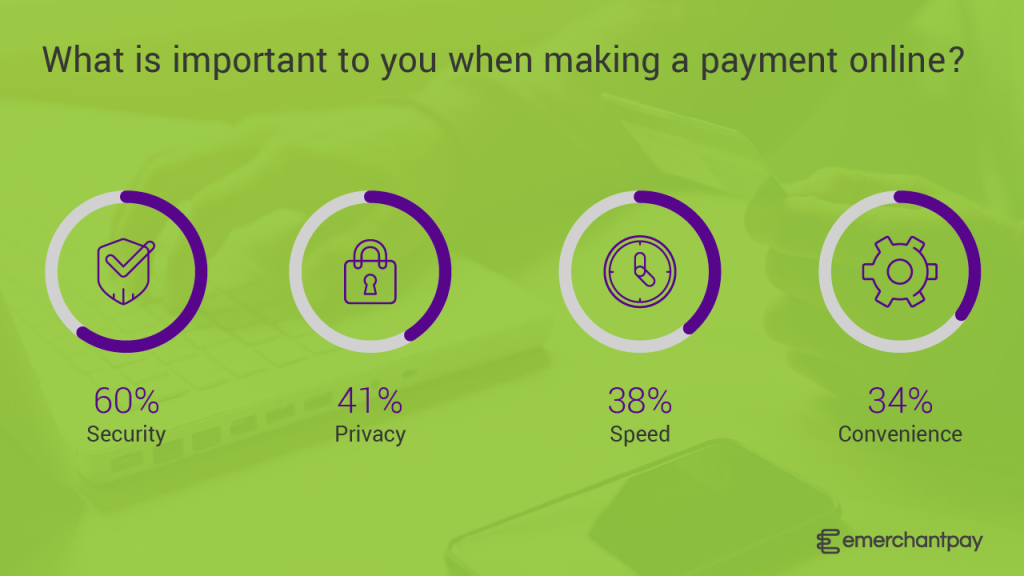

- Security (60%), privacy (41%), speed (38%), and convenience (34%) are the top factors influencing online payment decisions, all areas where Open Banking excels.

- 85% of respondents value real time access to their bank account balance, a unique feature of Open Banking.

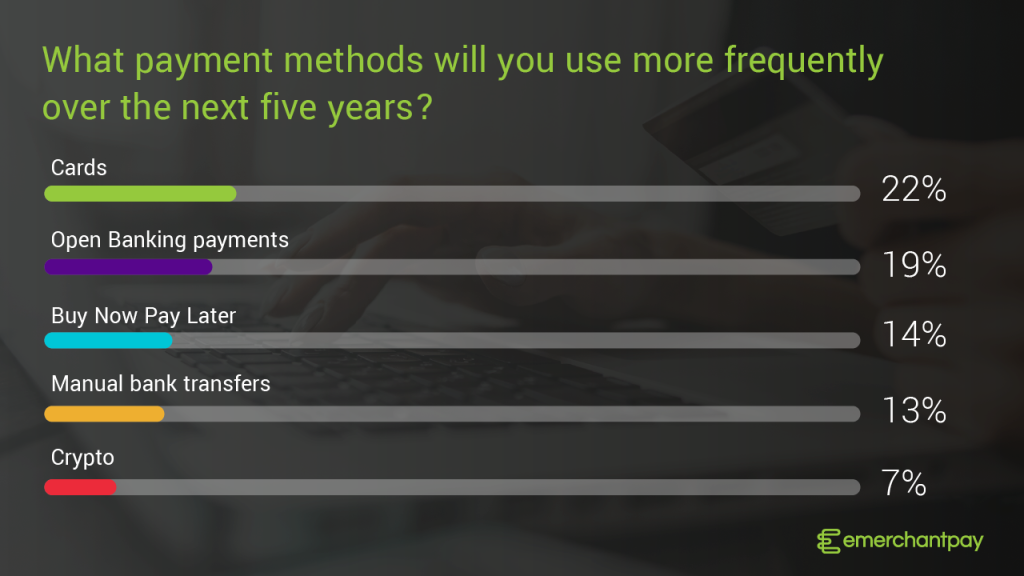

The research findings show that Open Banking is well on its way to capture market share with other mainstream payment methods in the future. While cards are expected to remain the preferred payment method over the next five years by (22% of respondents), Open Banking payments are not far behind. 19% of UK consumers showed a likelihood to increase their adoption of Open Banking in the coming five years, surpassing Buy Now Pay Later (14%), manual bank transfers (13%) and cryptocurrency (7%).

Stefanie Renz-Schreiner, Senior Business Development Manager at emerchantpay highlighted how the payments sector is undergoing exciting changes, driven by Open Banking innovations. These unique offerings present many benefits for businesses, including minimised chargebacks and improved payment experiences.

“To maintain agility and stay ahead of the curve, businesses can leverage this emerging payment protocol to cater to evolving consumer preferences and drive growth.” -Stefanie Renz-Schreiner, Senior Business Development Manager, emerchantpay

Despite the potential benefits of Open Banking, the report from emerchantpay highlights a significant gap in consumer awareness and understanding. Although 1 in 2 consumers are not familiar with the term Open Banking, upon learning its definition they admit to having used it as a payment method for their purchases. Furthermore, 39% of UK shoppers were worried about sharing financial information due to data leakages. Additionally, 38% worried about someone hacking into or stealing their phone and being able to make payments directly from their account.

There’s a clear need for education because interestingly, the study shows that Open Banking aligns perfectly with the key features consumers prioritise in payments such as security, privacy, speed and convenience. If financial institutions and merchants take a proactive role in demystifying it by highlighting its robust security features and the enhanced control it offers consumers over their financial data. It not only eases these concerns but can also drive adoption.

In conclusion, Open Banking is set to transform the payments landscape, offering significant benefits for both consumers and businesses. By embracing this innovative solution, businesses can align with evolving consumer preferences, enhance checkout experiences, and drive business growth in an increasingly competitive market.

Take advantage of the growing adoption of Open Banking and learn more about how it can help your business by downloading the full two-part report through these links:

This report was first published by emerchantpay and has been republished on our website with permission.

emerchantpay is a member of our Payment Service Provider panel.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.