Q&A with Colin Barnard at Criteo –“The Future of Retail Media”

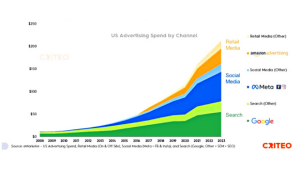

Colin Barnard presented his keynote, “The Future of Retail Media – 3 Key Trends to Know in 2023” at eTail Australia 2023. Retail Media is passing Search (Google) and Social Media (Facebook) as the most valuable real estate in digital advertising. Retail Media includes the big eCommerce marketplaces like Amazon. However, this is a much more fragmented market. Every retailer now online can participate.

Colin Barnard presented his keynote, “The Future of Retail Media – 3 Key Trends to Know in 2023” at eTail Australia 2023. Retail Media is passing Search (Google) and Social Media (Facebook) as the most valuable real estate in digital advertising. Retail Media includes the big eCommerce marketplaces like Amazon. However, this is a much more fragmented market. Every retailer now online can participate.

Payments Consulting Network Associate, Ross McIntyre, caught up with Colin Barnard, Managing Director ANZ at Criteo to discuss the future of Retail Media; new players, new formats and new dynamics. You can read the highlights of the conversation below.

RM: What is Criteo? What is your role?

CB: Criteoa assists with targeted display advertising using purchase intent data. It is retail media focused and has bidding platforms for optimising campaigns.

I am responsible for growing our Commerce Media business in Australia and NZ, building product and partnership strategies through agencies and resellers, and helping our customers strategically drive business results … helping businesses make their marketing not just more targeted and efficient, but also more relevant and accountable.

RM: What factors are driving Retail Media above other channels?

CB: Consumers are switching to searching for products more on retailer sites rather than just using the big search engines. Retailers are realising the power of their audiences and the data. This can be leveraged to promote brands and products to highly targeted audiences on or off site. In doing so retailers can monetise this opportunity in a relevant way with their customers.

RM: Who are the major players?

CB: Amazon is the father of retail media and created the category. In its wake came Criteo, Citrus Ad (Publicis) and Promote iQ (MicroSoft).

We are seeing more agencies and more APIs. Commerce aggregators such as Uber Eats can deliver in app ads. Connected TV (CTV) partners like The Trade Desk and Roku are being used by larger retailers such as Walmart and Kroger for shoppable ads and closed loop reporting .

US Advertising Spend, Retail Media, Social Media and Search (eMarketer)

RM: What sort of ad campaigns and formats are you seeing?

CB: Offsite is a huge area of growth with near limitless inventory. This will be a big trend to come.

For on-site we are progressing beyond Sponsored Products to rich media display units, video ad units and shop-in-shop. For example, Walmart has dynamic digital advertising in stores on their fridge doors. Different products can be promoted at different times of the day.

We are seeing the digitisation of physical retail media assets such as public displays (DOOH) and in-store screens. You will see more coordinated buying of all of these formats. This will enable closed loop reporting across multiple assets.

RM: What is closed loop reporting?

CB: Closed loop reporting is the ability to see actual sales outcomes from all of a brand’s marketing spend if, typically, done within one system.

For instance, a consumer electronics brand may have traditionally used TV and public displays (OOH) to advertise the launch of their latest mobile phone. They use metrics such as reach and frequency to plan their media spend. They also use other less obviously linked metrics such as total sales uplift and brand tracking research studies to gauge the effectiveness of their ad dollars.

This is in contrast to their more tactical digital marketing spend via Search, Social or Display which has typically been judged by online attribution.

However, where ads are booked digitally on a retail media platform, such as Criteo, you also get closed loop reporting. A brand could promote their new mobile phone to a retailer’s audience of customers who are viewing mobile phones either onsite or offsite. They can later see that the same user comes back and purchase. The ability to link more top of funnel advertising and eventual sales is a game-changer.

RM: How is Criteo able to bring the Retail Media channels together? What are the dynamics generally?

CB: Criteo believes in an open web beyond the walled gardens. We provide Commerce Max, a world-leading marketing platform. It is at once an SSP for retailers and a DSP for brands and agencies (sell side and demand side platform). It supports both onsite and offsite retail media assets. We also have a relationship with Magnite for CTV. We believe this puts us in a unique position to help the industry consolidate planning, buying, campaign management and reporting.

Additionally, Criteo is relatively unique in having dedicated teams who can drive incremental demand from brands and their agencies for retailers. So, we are more than just an Ad Tech platform. Instead, we aim to support retailers in leveraging the power of the brands that they sell and the funding that comes with that. Showing highly relevant ads to customers drives more online and offline store visits, increases basket size and delivers better ROI.

Enhanced reporting capabilities underpin the whole system. We are able to link campaigns at each stage of the funnel to an actual purchase. This provides omnichannel attribution. This helps Brands invest in Retail Media.

RM: How do you validate sales intent ? Do you work with payments providers?

CB: We are fortunate in having had our retailers share feeds and SKU level transaction data with us since the inception of Criteo. This is how our advanced AI algorithms put the right product in front of the right person at the right time.

We do work with data partners to enhance our algorithms but currently I do not believe we are working with payments providers.

RM: What metrics should retailers focus on?

CB: Retailers should focus on traditional retail metrics such as numbers of visits to the website or physical store and basket size – just as they have for years. Additionally, as they move into retail media, they should consider yield and sell-through rate as a publisher would in addition total ad revenue generated whilst keeping a watchful eye on core website metrics such as conversions etc.

RM: How important is AI?

CB: AI is critical in retail media. The complexity of showing the right ads to the right audiences at scale is a challenge that AI is perfect for. This is why Criteo has invested in our AI lab and why we are one of the leading Ad Tech companies in this field.

RM: What industry changes or trends do you see over the next 2-3 years?

CB: There will be more retailers realising the power of their 1st party audiences and realising that they can monetise this opportunity.

We will see a proliferation of smaller, niche players in each market. This will be followed by consolidation as Brands and their agencies look for operational efficiencies and the power of the larger platforms creates a network effect.

Finally, I see Brands consolidating their trade and marketing teams, or at their least investments. This will come as retail media blurs the lines of sponsored placements both in the digital and physical worlds.

Author: Ross McIntyre, Associate, Sydney, Payments Consulting Network

Ross McIntyre has over 15 years of experience in data science, financial analysis, and the preparation of business cases, proposals, and strategies. His experience includes business case lead on several end-to-end supply chain reviews, commercial lead on high-level pricing strategies, profit worker design for retail, and business case support for large corporate deals.

***

If you found this article helpful and would be interested in reading similar articles, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass on the top right-hand side of the website, and type in the keywords that interest you. You will then be presented with a list of any articles that Published On: 16 March 2023Categories: Blog, Profiles, Retail