Q&A with Peter Cowan at PayPal

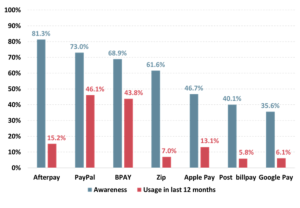

Roy Morgan’s data shows that PayPal is Australia’s most widely used digital payment platform ahead of BPAY. Over 9.8 million Australians (46.1%) used the service in the 12 months to September 2022. Block’s Afterpay has edged ahead on awareness. However, PayPal leads when it comes to customer trust.

Source: Roy Morgan Single Source, October 2021 – September 2022

This year PayPal won Australia’s Roy Morgan Trusted Brand Award for Non-Bank Financial Services. They topped over 50 well known brands including American Express, Mastercard, Visa and the ASX. In fact PayPal has led the category with the highest ‘Net Trust’ score since the survey began over four years ago.

Feedback from survey participants included: ‘I know any place that takes payments through PayPal can be trusted’ and ‘PayPal have never failed me. They guarantee me my money back if there’s any dispute with the seller. It’s a free service to buyers’.

Feedback from survey participants included: ‘I know any place that takes payments through PayPal can be trusted’ and ‘PayPal have never failed me. They guarantee me my money back if there’s any dispute with the seller. It’s a free service to buyers’.

Payments Consulting Network Associate, Ross McIntyre, caught up with Peter Cowan, Managing Director, PayPal Australia to discuss their recent Roy Morgan award and the importance of building a trusted brand.

You can read the highlights of the conversation below.

RM: What’s your role at PayPal?

PC: I’m responsible for leading all PayPal Australia’s client facing teams, managing our relationships with hundreds of thousands of merchants who utilise PayPal’s products which include our PayPal wallet, the Braintree payment platform and our Hyperwallet payout platform. I also chair our PayPal Credit business which provides working capital solutions to merchants and PayPal Pay in 4, our BNPL service, to our consumers.

RM: How important is brand trust compared with other factors like convenience and ease of use? What’s that worth to PayPal?

PC: In payments trust is the cornerstone of any solution. PayPal’s consumer research in Australia shows that the top online checkout barrier for Australians is security or trust issues at checkout, with 60% of Aussies stating this was a concern. Ensuring ease of use is also important for engagement, but trust is the ticket to play. We’re encouraged that our 9.3 million customers in Australia see us as the most trusted brand amongst non-bank financial institutions.

Trust in the PayPal brand has been hard won over more than 20 years in global digital payments and we understand that trust is the foundation of our business. We continuously evaluate our approach to data security, privacy, and identity to ensure we can maintain the confidence our customers place in us.

RM: What have been the critical features and technologies in building trust? How do you promote these with customers and with merchants?

PC: At the top level it is core to have a highly secure service to build trust in payments, but that’s not our sole area of focus. Other aspects such as privacy, dispute resolution, identity and buyer/seller protections are also important elements to maintain our customers’ trust.

At a more granular level, the provision of buyer and seller protection for qualifying transactions has been one of the key product features that has helped build trust in PayPal’s wallet. Overlaying this feature, we deliver a simple servicing solution that allows customers to make claims in the event something has gone wrong with a qualifying transaction – such as if their purchase doesn’t arrive or is damaged on arrival.

The final element I consider key for maintaining trust is consistency. Having been in Australia since 2005, we have demonstrated our commitment to providing solutions which have proven trusted, convenient and secure over the long term for Australian consumers and businesses.

RM: What happens to make this all possible? What sort of back-end teams / processes are involved?

PC: I couldn’t possibly do all the teams that are involved in delivering our services justice in a reasonable amount of time. The quick answer is that this is all made possible through orchestration of a large group of global employees who collaborate to deliver the end-to-end solution for our Australian customers. Key teams are Product Management who develop relevant solutions to address client needs; Technology who keep things secure and running 24×7; Risk who minimise friction while also minimising losses; and Customer Service who interact with our customers who need help. All these teams and more need to collaborate to deliver our service end to end.

Needless to say, we are constantly adapting as the environment changes, while also innovating to strengthen our security posture.

RM: How do you protect the customer? Are there any additional security or fraud risks you need to manage?

PC: Because we operate in over 200 markets and have a 2-sided network covering 430 million accounts across both consumers and merchants, we have a huge amount of data that helps inform our security modelling to protect customers. Through the use of industry leading tools and also our own proprietary capabilities, we work to use this vast amount of data intelligently to close the loop between speed, convenience, and safety.

Our Decision Sciences and Risk Management teams do a great job of curating portions of this data into the most relevant information to develop powerful AI/ML models that maximise approvals for good users, while preventing fraudsters and inappropriate persons and businesses from abusing our platforms. We combine human resources and teams with large-scale data – using Machine Learning to generate real-time, near-real-time and batch-based advanced analytics compute and velocity engines to generate business insights by learning user’s behaviors, relationships, interests, and spending habits. Some interesting stats are that we have more than 1,000 data science engineers that are exclusively focused on fraud prevention and over 100 models are computed in real time during payment processing. We have over 400 fraud models and 65,000 individual rules in our engine.

RM: PayPal has been facilitating the trading of crypto currencies for a while now. How effective has this been in growing PayPal? How important is this going forward?

PC: Here at PayPal, we created a new business unit in early 2021 focused on blockchain, crypto and digital currencies (BCDC) and our customers in the US and UK can buy, hold and sell cryptocurrency using PayPal and in the US, our customers can checkout with crypto on PayPal as well as transfer, send and receive crypto on the PayPal platform.

While it is early days for crypto as an alternative to fiat currency, we believe in the potential of blockchain, digital currency and crypto over the long term and are ensuring we build compliant solutions using these technologies.

RM: Many people do not trust crypto currencies. Could this adversely impact brand trust?

PC: For customers that don’t trust cryptocurrencies there is no need for them to engage in this part of our solution, so I don’t believe it has the potential to effect brand trust broadly. In the larger scheme of things I believe our solution actually has the potential to increase trust in the crytpo space, where PayPal can help mainstream the use of crypto and provide a level of trust to consumers which may have been missing in the crypto space to date.

RM: Elon Musk says Twitter will revive the “X” master plan from his PayPal days. What’s he on about?

PC: That’s probably a question for Elon. My understanding is that back in 1999 X.com was building what we would now call a Neobank before merging with Confinity to then pivot to create the PayPal wallet.

RM: What’s coming next at PayPal? What are your priorities right now?

PC: Top three priorities globally are enhancing our checkout and Braintree solutions and growing our Pay Later offerings, which includes our PayPal Pay in 4 service in Australia.

We have three major areas of focus for checkout, which is the ‘pay with PayPal’ experience: first, elevating and optimizing the consumer experience; second, providing merchants with a seamless integration experience and a one-stop shop for payments; and third, innovating new checkout solutions.

Braintree, which is PayPal’s payment platform for card processing and alternate payment acceptance, is a key growth area for us and we will continue to invest to further enhance the platform. Globally, Braintree payment volume grew 38% in the last quarter. Our Braintree momentum is driven largely by recent merchant wins and share of wallet expansions.

Continuing growth of PayPal Pay in 4 is also a priority. We recently won the Canstar awards for best merchant and best consumer BNPL product in Australia, which we are incredibly proud of given our relatively recent entry into this segment. PayPal Pay in 4 has no fees or interest charges for consumers and no additional costs for merchants beyond their existing account arrangements.

RM: What industry changes or trends to do you see over the next 2-3 years?

PC: Key trends to watch at a technology level are the rise of new ways to pay such as the internet of things / smart devices taking over the more mundane purchases we make. The metaverse / Web 3.0 also has the potential to change the way people interact with digital content through things like augmented reality and virtual reality.

At a payment infrastructure level, I think real-time payments, open banking, and central bank digital currencies or stable coins are some of the key trends that will drive changes to the way we pay in the future.

Author: Ross McIntyre, Associate, Australia, Payments Consulting Network

Ross McIntyre has over 15 years of experience in data science, financial analysis, and the preparation of business cases, proposals, and strategies. His experience includes business case lead on several end-to-end supply chain reviews, commercial lead on high-level pricing strategies, profit worker design for retail, and business case support for large corporate deals.

***

If you found this article helpful and would be interested in reading similar articles by our consulting team, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass in the top righthand side of the website, and type in the key words that interest you. You will then be presented with a list of any articles that match your search criteria.