The Paypers Payment Methods Report 2023

In today’s digitally-driven landscape, industry stakeholders, particularly merchants, payment service providers (PSPs), and fintech companies, forge ahead with innovation, striving to elevate the customer experience. Their goal is to offer seamless checkouts and an effortlessly smooth shopping journey, whether online or in physical stores. Key trends that have shaped e-commerce and payments in recent years such as convenience, speed, and security, remain pivotal in driving payment advancements, bolstering competitiveness and fostering growth.

In today’s digitally-driven landscape, industry stakeholders, particularly merchants, payment service providers (PSPs), and fintech companies, forge ahead with innovation, striving to elevate the customer experience. Their goal is to offer seamless checkouts and an effortlessly smooth shopping journey, whether online or in physical stores. Key trends that have shaped e-commerce and payments in recent years such as convenience, speed, and security, remain pivotal in driving payment advancements, bolstering competitiveness and fostering growth.

With an unwavering commitment to keeping you informed about the latest industry developments, this 8th edition of the Payment Methods Report from The Paypers Team delves into cutting-edge technologies that are revolutionising the global payments landscape. It presents a comprehensive view of how consumers prefer to shop and pay, providing invaluable guidance for merchants aiming to continually meet these evolving demands.

In this report, you will find:

- Latest trends in the payment methods space in 2023

- How customer expectations and experiences will change by 2030

- Most recent updates in consumers’ payment habits

- Use cases and benefits of Buy Now, Pay Later to B2C and B2B ecommerce

- Global overview of account-to-account payment methods

- Innovation in payment technology

- Checkout optimisation and payment integration

The past few years have seen a rapid rise in the number of payment types available in any given market. Whether it is a new digital wallet service,

a BNPL (Buy Now, Pay Later) service or an Open Banking payment option, these methods are multiplying quickly. As such, this presents merchants with a new debate – which to accept?

Historically, cross-border payments have not only been slow and costly but there has also been a considerable lack of process transparency, with money flowing through many different parties. These challenges are beginning to be addressed by two key technologies we will see progress over the coming months – CBDCs (Central Bank Digital Currencies) and stablecoins. Stablecoins, a type of cryptocurrency with its value linked to fiat currency, have been a major way parties have been addressing cross-border payments, improving both costs and speed, by bypassing traditional cross-border networks.

Latest updates in payment habits

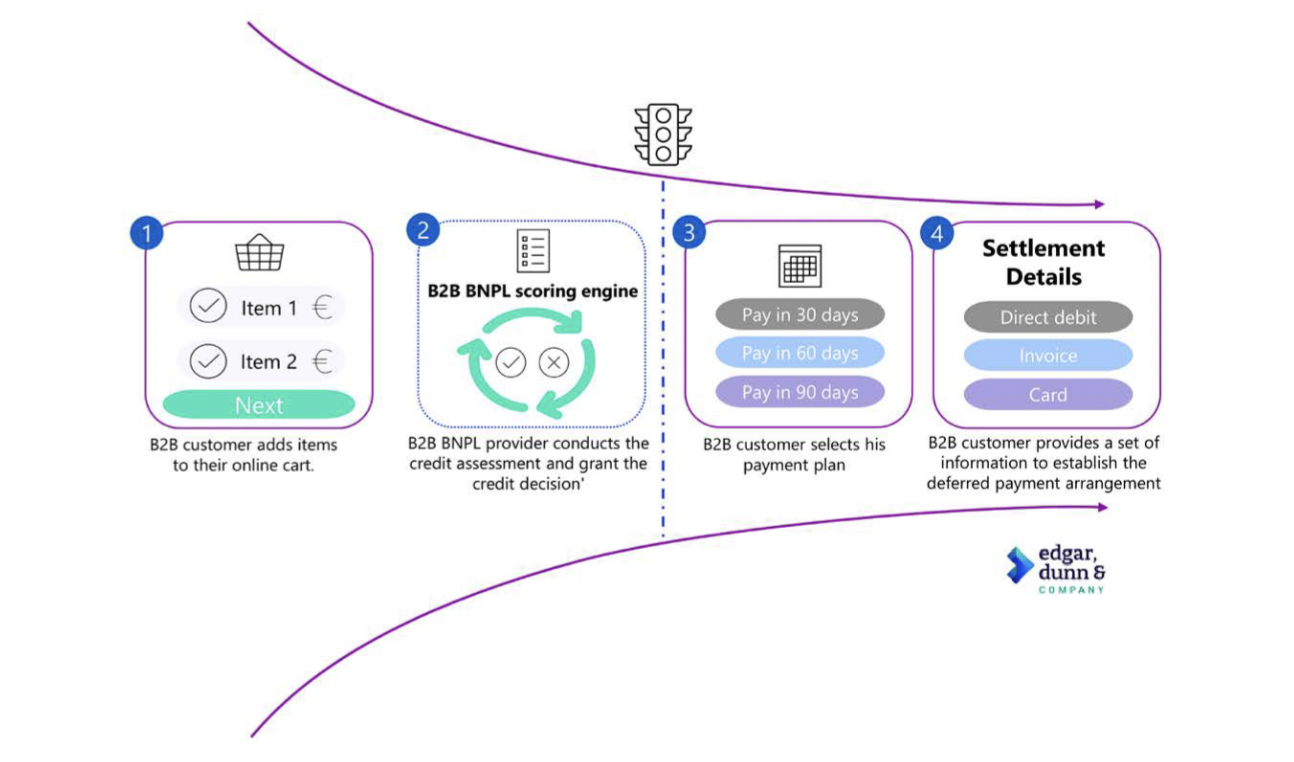

Edgar Dunn & Company (EDC) believes the potential of Business-to-Business (B2B) Buy Now, Pay Later (BNPL) will go beyond the B2B ecommerce ecosystems. B2B BNPL solutions can integrate with Accounts Receivable (AR) solutions to facilitate payment notifications that include the option of utilising BNPL. This could be an easy win for B2B BNPL to increase market reach. Such initiatives can be embedded in procurement or supply chain systems. There is a plethora of opportunities for B2B BNPL providers to investigate and untap new segments.

EDC forecasts global transactions between corporates to reach USD 113 trillion in 2023. The World Trade Organisation estimates that up to 80% of global trade between organisations relies on trade credit. The Net Present Value of trade credit is huge, and this is where the B2B BNPL opportunity exists.

While the average basket value in B2B is significantly higher than in B2C, business-focused BNPL is expected to be less regulated than B2C BNPL, and organisations are less likely to overspend on impulse buying than consumers. B2B BNPL is available to B2B businesses of all sizes and a wide variety of verticals, including manufacturing, IT, insurance, healthcare, pharmaceuticals, travel, transportation, logistics, real estate, and construction.

More to this point, Worldpay estimates that in 2022 BNPL accounted for 5% of all ecommerce transactions worldwide – and is anticipated to continue to earn market share in the following years. One can also observe that, while a few years ago Australia and Sweden were among the top markets in this space, now, Germany, the Netherlands, and the US are catching up – with ecommerce transaction values estimated to reach 25%, 14%, and 7% respectively by 2026, as per Worldpay’s report. In this context, BNPL 2.0 is expected to experience sustained growth and remain relevant to the payment mix.

Evolving payment habits – super apps and social commerce

Adam Caines, Associate at the Payments Consulting Network, reports that in the coming decade, social media platforms will evolve from mere communication tools into full-fledged shopping destinations. Social commerce will become the norm, and users will be able to make purchases directly through their favourite platforms.

Picture this: you are scrolling through your favourite social media app, and you stumble upon a product that catches your eye. With a single click, you can view product details, read reviews, and make a purchase, all without leaving the app. Social media payments will be tightly integrated with user experiences, and AI algorithms will personalise product recommendations based on your interests and social connections. Brands will collaborate with influencers to create immersive, personalised, and interactive shopping experiences. As technology continues to advance and consumer expectations evolve, the payment industry must pivot to align with the needs of the modern shopper. Embracing these changes will not only benefit businesses but also create a more convenient and enjoyable shopping experience for customers globally.

In this dynamic landscape of digital innovation, Finance Incorporated Limited (FIL) stands firm in its commitment to embrace cutting-edge solutions. Alongside the realm of traditional digital payments, FIL supports the future-forward world of cryptocurrency. Recognising the transformative potential of blockchain and decentralised finance, FIL is actively exploring avenues to integrate and facilitate crypto payments within its offerings.

In terms of digital payments, the world should be a place where all individuals, regardless of their socio-economic background, can seamlessly participate in the new financial paradigm. Embracing crypto payments is one of the many ways towards a more decentralised future, which can further enhance digitalisation and drive financial inclusion.

As emerging digital payment alternatives are established, consumers’ payment preferences will continue to also evolve. It could mean that they swap out one payment method for another or that their overall range of preferred payment choices expands. An example is mobile payments, and the top use cases include bill payments (39%), online payments (33%), and P2P payments (31%).

Innovation in payments technology

In an era when online shopping and digital banking have become the norm, the need for secure authentication methods has never been greater. In this segment contributed by Payments Consulting Network Commercial Director, David True discusses how when coupled with contactless payment options, biometrics becomes a powerful tool with myriad applications. Biometric payments offer a seamless and secure way for consumers to verify their identity, reducing the risk of unauthorised access and identity theft.

In physical stores, biometrics is revolutionizing the checkout process. For instance, Amazon Go stores utilize cutting-edge technology for a checkout-free experience. Customers simply enter, scan their Amazon app, and are authenticated via their face or palm. Their purchases are automatically registered and charged to their Amazon account upon exit. This delivers an effortlessly smooth in-store payment experience. Payment cards, too, are getting into the game, with embedded biometric sensors that eliminate the need for PIN codes. These cards enhance security by incorporating fingerprint scanning for authentication. This improves security over chip and PIN cards, all while delivering a seamless and convenient experience for users.

Specifically created with merchants, PSPs, fintechs, and enterprise leaders in mind, the report summarises more of the latest trends in the world of payments – and will benefit all the players in this space by featuring insights on specific industry topics.

Download the full report here.

***

Payments Consulting Network proudly serves as an Endorsement Partner of The Paypers.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.