Unlocking Efficiency and Growth: The Benefits of Multi-Acquirer Payment Solutions with Payment Orchestration

As the ecommerce landscape constantly changes, merchants increasingly face the challenge of staying ahead in a fast-paced and dynamic market. One crucial aspect that businesses need to optimise is their payment processing infrastructure.

As the ecommerce landscape constantly changes, merchants increasingly face the challenge of staying ahead in a fast-paced and dynamic market. One crucial aspect that businesses need to optimise is their payment processing infrastructure.

In this original article from Paydock, it is highlighted that a multi-acquirer payment solution, coupled with a payment orchestrator featuring automated routing rules, has emerged as a game-changer for merchants looking to streamline their operations, enhance customer experience, and foster growth.

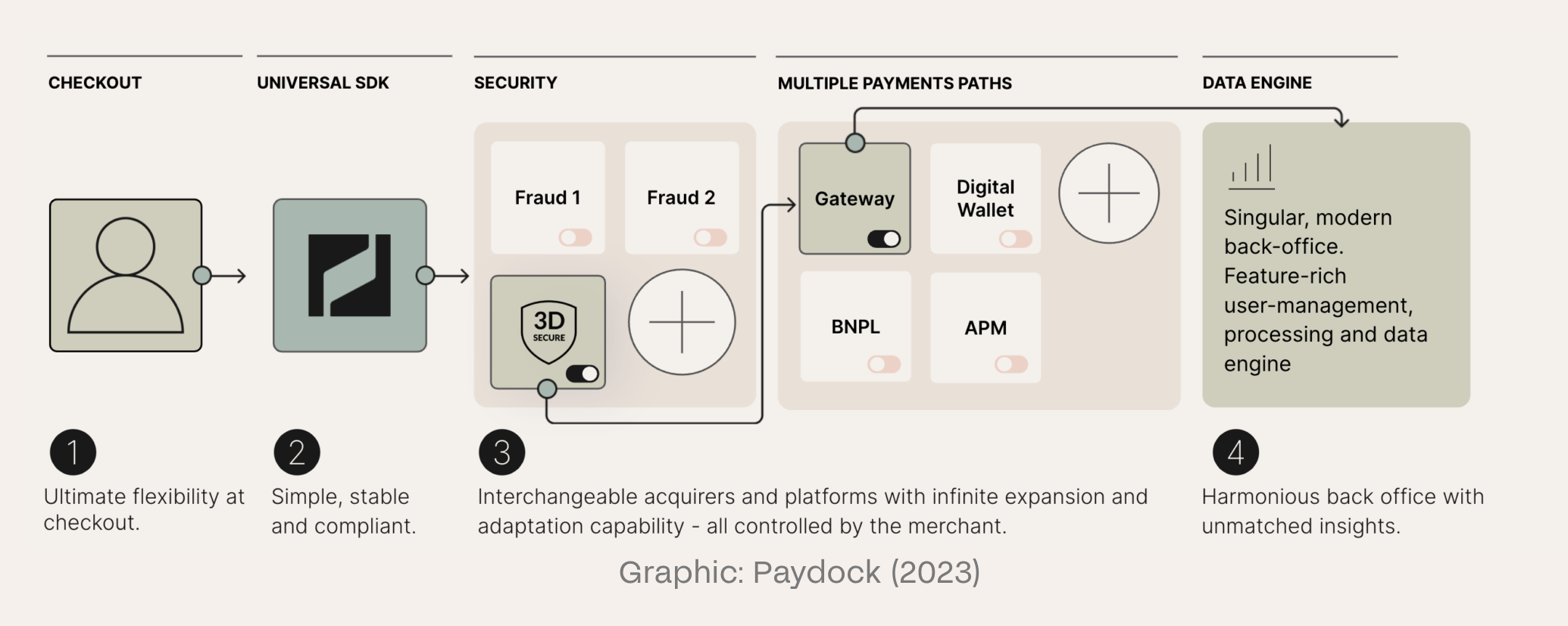

What is a multi-acquired payment orchestrator?

A multi-acquirer payment orchestrator is a payment platform that streamlines and optimises the payment processing landscape for merchants. The orchestration platform acts as a centralised hub, connecting with multiple acquiring banks, financial institutions and payment methods (i.e. PayPal, BNPL, Apple Pay, Google Pay).

A multi-acquirer payment orchestrator can dynamically route transactions based on predefined rules and real-time data analysis. The intelligent orchestration routing ensures enhanced reliability, improved cost management and authorisation optimisation.

This empowers merchants to automate failover, route based on optimised cost, and approval rate, adapt checkout screens to market trends, comply with regional regulations, and provide a robust and flexible payment infrastructure for their businesses.

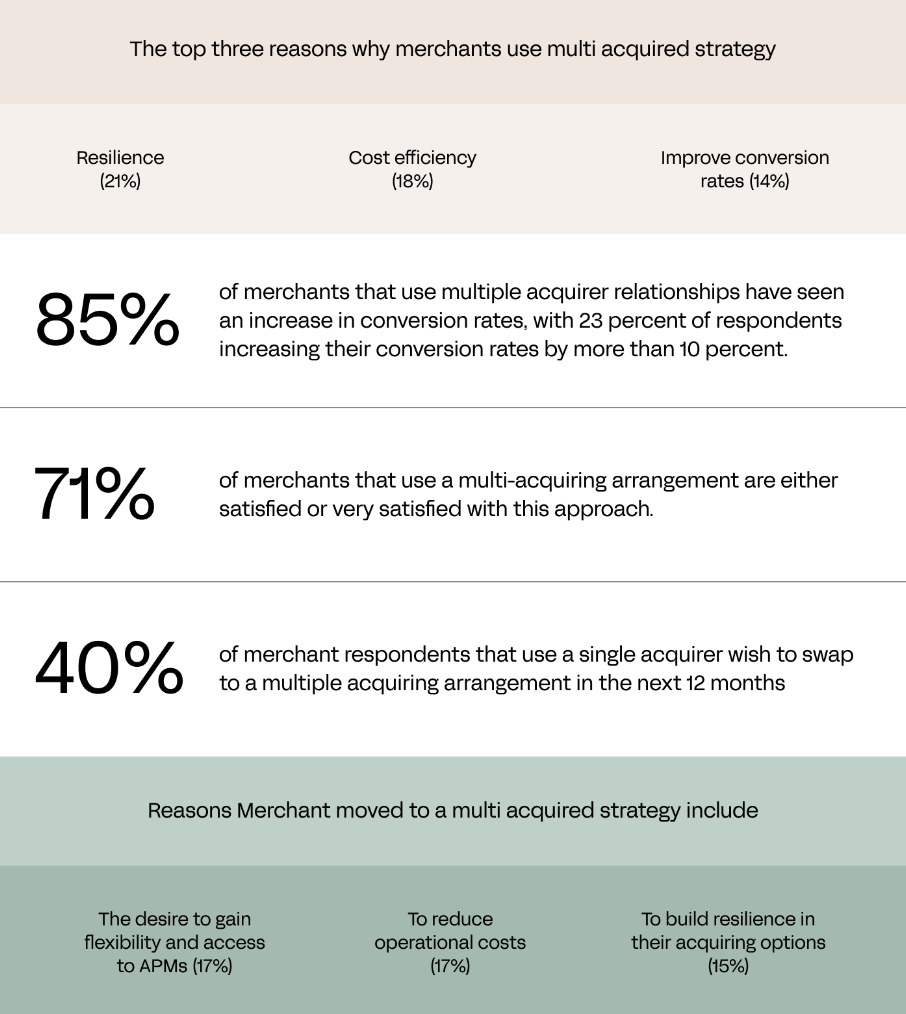

A study of merchants ACI Worldwide and Edgar, Dunn & Company found 85% of Merchants with multi-acquiring strategy saw a rise in conversion rates.

Summary of key survey findings for merchants:

Source: Worldwide, Edgar, Dunn & Company (2021)

Source: Worldwide, Edgar, Dunn & Company (2021)

Optimised Cost Management

With multiple acquirers, merchants have the benefit of negotiating better rates and terms due to their ability to easily move volume to a different acquirer, leading to cost savings.

The ability to dynamically route transactions based on predefined rules allows merchants to optimise costs further. In addition to multiple acquirers, dynamic routing can also be used to take advantage of local payment rails i.e. Australian merchants can use Rules to automatically route card payments via EFTPos rails rather than Visa/Mastercard. This usage allows merchants to take advantage of improved local rails pricing.

There are payment orchestration platforms, with automated routing rules that can analyse real-time data including currencies, amount, payment source type, scheme, and processing network. These can offer the additional benefit of customisation via the custom field settings.

Diversified Payment Options

One of the primary advantages of adopting a multi-acquirer payment solution is the ability to offer customers a wide array of payment options. Different customers prefer different payment methods, and by integrating multiple acquirers, merchants can cater to diverse consumer preferences, ranging from credit cards and debit cards to digital wallets and alternative payment methods. This diversification not only improves customer satisfaction but also expands the merchant’s reach to a broader audience.

Example:

Whilst there are a multitude of payment options available in Europe, the overall leaders as indicated by data from Builthwith and Merchant Machine, are:

PayPal (23.14%)

Visa (18.73%)

Mastercard (10.50%)

American Express (6.12%)

Apple Pay (5.895%)

This leader group typically reflects most regions, and it is advisable for merchants and financial institutions to include them as part of their standard offerings.

The remaining 35% is spread across a variety of payment types:

Source: Builtwith and Merchant Machine

Enhanced Reliability and Redundancy

Multi-acquirer solutions provide merchants with increased reliability and redundancy in payment processing. In the event of downtime or issues with one acquirer, transactions can seamlessly be rerouted to alternative acquirers, ensuring that payment processing remains uninterrupted.

Most solutions experts, such as Paydock, offer PCI-compliant website widget and APIs are acquirer-agnostic. This means that in the event of an acquirer or gateway failure your customer checkout experience remains consistent. The seamless redundancy switching minimises the risk of lost sales due to technical glitches, providing merchants with a robust and dependable payment infrastructure.

Adaptive to Market Trends

The payments landscape is dynamic, with new technologies and trends emerging regularly.

A multi-acquirer solution, coupled with a payment orchestrator, allows merchants to adapt quickly to these changes. Whether it’s supporting new payment methods, complying with security standards, or integrating with the latest technologies, this flexible infrastructure ensures that merchants stay at the forefront of industry developments.

One of the biggest benefits merchants and financial institutions (FIs) have when utilising payments orchestration platforms is the ongoing expansion of products and services. By leveraging such platforms, organisations are relieved of the burden of bearing the costs associated with continuous improvements. As these platforms evolve, they introduce new functionalities, payment methods, gateways and acquisitions benefiting different users across the board.

Customer Credential Centralisation

Acquirer-agnostic payment tokens represent a cutting-edge development in the realm of secure and versatile digital transactions. These tokens are designed to be stored in highly secure vaults, leveraging advanced encryption and authentication protocols to ensure the utmost protection of sensitive financial information. Unlike traditional payment methods tied to specific acquiring banks or processors, acquirer-agnostic tokens provide a universal solution that is compatible across various payment networks, allowing for seamless transactions regardless of the underlying financial institution.

To streamline and orchestrate the usage of these payment tokens, a payment orchestrator comes into play. This orchestrator serves as a central hub, managing and facilitating transactions across diverse payment networks. It provides a unified interface for merchants and financial institutions, abstracting the complexities of interacting with various acquirers. Additionally, the payment orchestrator enables functionalities similar to network tokens, allowing for secure and standardised transactions across a wide range of platforms and services. This innovative approach not only simplifies the payment process but also enhances the security and interoperability of digital transactions in an increasingly interconnected financial landscape.

Empowering Merchants with Payment Orchestration for a Competitive Leap

The adoption of a multi-acquirer payment solution, augmented by a payment orchestrator such as Paydock with automated routing rules, offers merchants a strategic advantage in the highly competitive world of commerce.

From providing a diverse range of payment options to optimising costs, ensuring reliability, and adapting to market trends, this integrated approach not only improves the efficiency of payment processing but also sets the stage for sustained growth in an ever-evolving business landscape. Merchants who embrace these technologies position themselves as innovators, ready to meet the demands of today’s dynamic market and future-proof their operations.

Author: Sham Visavadia, Solutions Consultant, Paydock

This article was first published by Paydock and has been republished on our website with permission.

Paydock is a member of our Payments Orchestration Panel.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Merchant Advisory company LinkedIn page, and click on the bell icon at the top right section of our company profile.